THE ASAN PUBLIC OPINION BRIEF

Tax Reform

TAX BURDEN OF THE TAX REFORM BILL

August 12-14

Who do you believe will bear the greatest burden from the Tax Reform Bill?

(%)

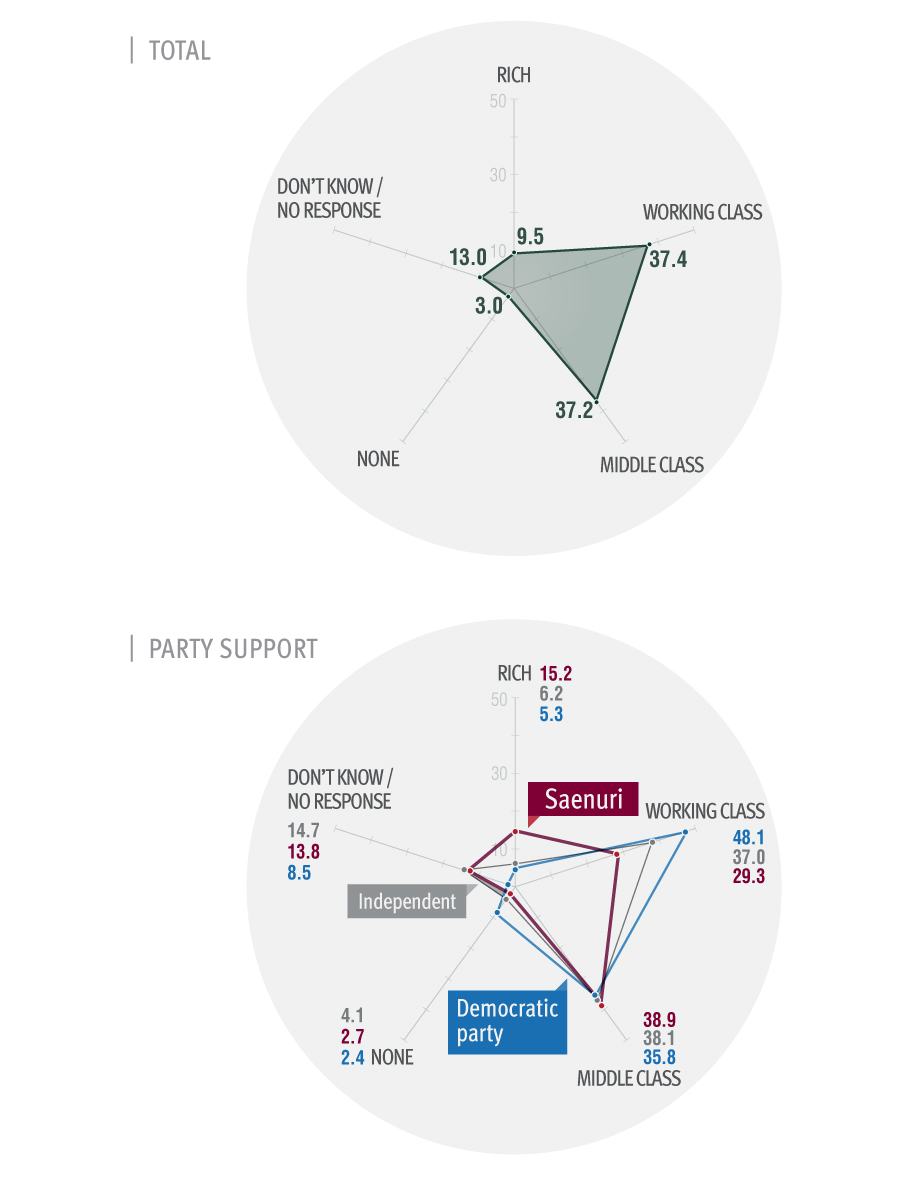

Koreans believed that the middle class and working class would bear the brunt of the tax burden from the Tax Reform Bill. When asked, 37.4% responded that the “working-class” and 37.2% the “middle-class” would bear the greatest burden. A mere 9.5% responded that the bill would increase the burden of the rich. The polls may reflect the framing effect of the news media coverage and portrayal of the Tax Reform bill as a middle class tax hike.

Party Affiliation

The opinion that the middle class and working class will shoulder the tax burden was shared among Saenuri Party supporters, Democratic Party supporters, and independents. However, more than twice as many Saenuri Pary supporters (15.2%) responded that the rich will bear the burden than Democratic Party supporters (5.3%) and independents (6.2%).

METHODOLOGY

- The sample size of each survey was 1,000 respondents over the age of 19.

- The surveys were conducted by Research & Research, and the margin of error is ±3.1% at the 95% confidence level.

- All surveys employed the Random Digit Dialing method for mobile and landline telephones.

3-day rolling average?

The sample size of each survey was 1,000 respondents over the age of 19. The surveys were conducted by Research & Research, and the margin of error is ±3.1% at the 95% confidence level. All surveys employed the Random Digit Dialing method for mobile and landline telephones.

This brief is a product of the Public Opinion Studies Center at the Asan Institute for Policy Studies.

Contact Karl Friedhoff at klf@asaninst.org.

Facebook

Facebook Twitter

Twitter