Introduction

“Maximum pressure and engagement campaign” –or maximum pressure campaign for short— debuted in April 2017 after a two-month policy review conducted by the then newly inaugurated Trump administration, with the central premise that unprecedented economic pressure on the Kim Jong Un regime, made possible by a cooperative China, would compel North Korea to denuclearize. Yet three years since the campaign’s debut, the maximum pressure campaign is no longer what its name connotes.

From the detailed reading of the UN Panel of Experts reports published in 2018 and 2019, a disturbing picture emerges: North Korea’s two main areas of sanctions evasion, coal export and procurement of refined oil, expanded greatly between 2018 and 2019 as to make a mockery of maximum pressure name. This study estimates that the revenue from North Korea’s illicit coal export may have doubled, from USD $169 million in 2018 to at least USD $346 million in 2019. Its procurement of refined oil not only breached the annual cap of 500,000 barrels imposed by the UN resolution, but in 2019 it increased by 37% compared to 2018. It may even have returned to the pre-sanctions level of imports of 4.5 million barrels.

It is generally understood China and Russia abet North Korea’s evasive actions. For instance, the 2019 UN report describes how North Korean coal were shipped from North Korean ports to users located along the Yangtze river in China’s interior on Chinese owned barges. Russia is suspected to have relocated hundreds of North Korean workers from its territory to Abkhazia, a self-declared state that most countries recognize as part of the Republic of Georgia.

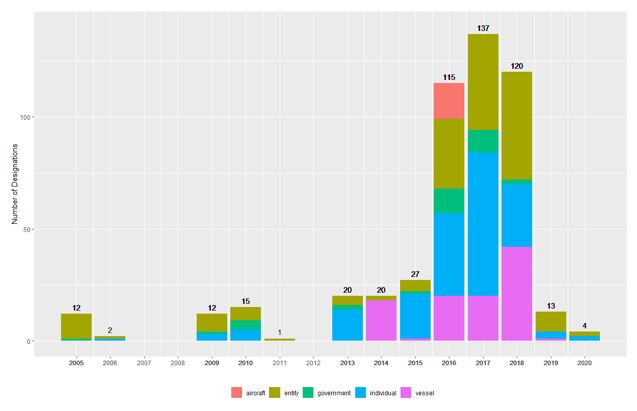

However, it has always been the case that what compelled UN member states to abide by sanctions resolutions were American diplomatic and economic pressures. Yet “pressure” from the “maximum pressure” campaign fizzled out in 2019. The number of newly sanctioned individuals, entities, and vessels/aircrafts designated by US Treasury Department dropped from 120 in 2018 to mere 13 in 2019. The drop was even more dramatic for new vessel designations, which decreased from 42 in 2018 to one in 2019.

The paucity of new vessel designations is surprising because illicit ship-to-ship transfers (STS) conducted in open sea by oil tankers and coal cargo ships is the critical instrument that enables North Korea to evade international sanctions. Numerous foreign-flagged ships joined North Korea’s illicit activities in 2019, which greatly aided regime’s efforts to undermine the sanctions regime. Yet none of the newly joined ships in 2019 has so far been designated by either the US Treasury Department or United Nations.

The upward trend in sanctions violations could not have escaped the attention of Trump administration. As a matter of fact, most of the analyses of North Korean violations presented in UN reports had been provided by United States. Yet the extraordinary gap between sanction enforcement and violations persists to this day, suggesting that letting off pressure on North Korea has been a deliberate policy choice of the Trump administration.

Data and Methodology:

This study aims to elucidate North Korea’s sanction evasion activities using information and data from the 2018 and 2019 UN Panel of Experts (PoE) reports1 2 as well as sanction designations3 and sanctions advisory4 from the Office of Foreign Assets Control (OFAC) of the US Department of Treasury. In addition to analyses of UN PoE reports and OFAC designations, this study focuses on two main areas of North Korea’s illicit activities: coal trade and procurement of refined oil.

The two annual UN PoE reports present rather incomplete estimates of North Korea’s illicit activities. Originally produced by the US government, these estimates were based on observations of port calls by ships suspected of having engaged in illicit activities, which were tracked by satellites and other remote sensing assets. For reasons unclear, the estimates were not for the full year but ended in August for 2018 and October for 2019. Yet one helpful pattern was evident in the data: the bulk of activities were conducted by ships of similar cargo capacity, and their port calls were rather evenly spaced out. It would be safe to assume these ships had returned to North Korea on regular basis for the remainder of the year.

This study took advantage of the regularity of port calls and used linear extrapolation methods to generate full annual estimates of North Korea’s coal trade and STS transfers of refined oil. Some important assumptions were made in the process, such as the loading rate of the cargo vessels and frequency of trips made by the ships, which were based on information provided by a maritime database and other independent research.

Expansion of North Korea’s procurement of refined oil

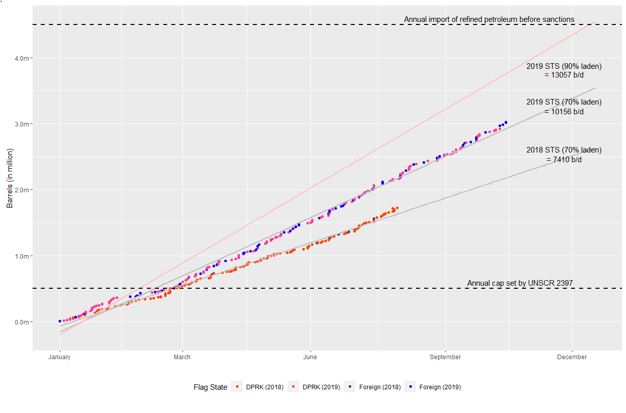

Even though the UN resolution 2397 capped the annual import of refined oil by North Korea at 500,000 barrels a year, North Korea was almost certainly able to surpass the cap from the very beginning. Not only that, North Korea has been able expand its evasion activities unfettered in 2019 by adding several foreign-flagged oil tankers. Figure 1 shows how North Korea may have been able to make up for much of the shortfall in oil imports caused by sanctions.

Figure 1. 2018-19 Estimation of total refined oil procured through the Ship-to-Ship (STS) transfer scheme

Source: author’s analysis of UN Panel of Experts reports (2018, 2019)

Source: author’s analysis of UN Panel of Experts reports (2018, 2019)

The trend lines5 in Fig. 1 are extrapolations based on the estimates provided by the United States government to the UN Panel of Experts. The surprising regularity of oil tankers’ visits to North Korean ports, which on average took place every 1.55 days in 2018 and 1.37 days in 2019, allowed for a good model fit.

Given the dangers involved in STS transfer operations, it is likely North Korea avoided “topping off” the tankers to maximum capacity while trying to load up as much oil as possible, leading to lower average loading rates. At the same time, the report also mentions the growing number of direct deliveries of refined oil made to Nampo, North Korea, presumably with higher loading rates6. Figure 1 uses the loading rate of 70%7, as it reflects both the lower loading rates of STS transfer operations and higher loading rates in direct deliveries.

With 70% loading rate, it is estimated North Korea imported on average 7,410 barrels of refined oil per day in 2018. As more ships became involved in the illicit activities in 2019, the average number of barrels imported per day increased to 10,156, or 37% more compared to 2018. With this expansion it became theoretically possible for North Korea to completely nullify the impact of import ban on refined oil, as with the maximum loading rate of 90% (red trend line in Graph 1), North Korea’s oil tanker fleet in 2019 would have been able to ferry almost 4,500,000 barrels of refined oil. It was estimated that North Korea was importing 4.5 million barrels of oil per year in addition to 5 million barrels of crude oil before the annual cap was imposed in 20178.

The role of foreign-flagged oil tankers:

North Korea was able to overcome the cap on refined oil import by expanding its fleet of oil tankers with foreign-flagged vessels. Table 1 shows that the total fleet capacity in terms of barrels almost doubled from 418,335 barrels in 2018 to 796,328 barrels in 2019, an increase of 90%. Almost all of the additional capacity in 2019, 354,585 barrels, was provided by the foreign-flagged oil tankers, which on average had bigger cargo capacity than their North Korean counterparts. Together, 28 North Korean and 11 foreign-flagged oil tankers participated in illicit STS transfer activities in 2019, as opposed to 24 North Korean and 2 foreign-flagged ships9 in 2018.

Table 1. Total capacity of North Korea’s oil tanker fleet by flag state

| 2018 | 2019 | ||

| Capacity in Barrels | DPRK | 366,135 (88%) |

441,743 (55%) |

| Foreign-flagged | 52,200 (12%) |

354,585 (45%) |

|

| Subtotal | 418,335 (100%) |

796,328 (100%) |

Source: author’s analysis of UN Panel of Experts reports (2018, 2019)

The involvement of foreign-flagged vessels in North Korea’s procurement of refined oil, either through STS transfer or direct delivery, is in violation of UN Security Council resolutions, which together ban all leasing or chartering vessels/aircraft and provision of crew services to North Korea10, ship to ship transfer of banned items –which includes refined oil11, and the sale or transfer of refined oil to North Korea12.

Despite the comprehensive ban on transactions and activities that facilitate North Korea’s procurement of refined oil, the increased involvement of foreign-flagged ships indicates that the owners and managers of these ships perceive the risk of punishment to be low compared to the payoff. In fact, only one foreign-flagged vessel (see footnote 7) was sanctioned by the United States government in 2019. Even then, the illicit activity that formed the ground for sanction designation had taken place in 2018.

North Korea’s Illicit Coal Exports

Coal was a major source of foreign currency earnings for North Korea before its import was completely banned by UN resolution 2371 in 2017. Before the ban, North Korea was exporting more than USD $1 billion worth of coal annually13. It is clear that the ban on coal export dealt a painful blow to the North Korean economy, and the regime attempted to continue the lucrative trade. As outlined in two UN PoE reports, North Korea devised clever ways to defeat the sanctions measures with active involvement of foreign businesses and vessels. The comparison below between 2018 and 2019 describes how the scale and tactics of North Korea’s illicit activities evolved between the two years.

Table 2. Trends in North Korea’s illicit coal trade

| 2018 | 2019 | |

| Quantity and Revenue | – 1.97 million tons (median) – USD $169 million (median) |

– 5.55 million tons14 – USD $346 million (w/ discount) – USD $433 million (@ market price) |

| Modes of Transport | – At least 49 bulk cargo ships | – In addition to the 2018 fleet, at least 37 Chinese owned ocean-going barges15 |

| Delivery Locations | – Gulf of Tonkin (STS transfers) | – Yangtze river estuary (direct delivery) – Gulf of Tonkin and Ningbo-Zhoushan and Lianyungang port areas in China (STS transfers) |

Source: author’s analysis of UN Panel of Experts reports (2018, 2019)

Table 2 shows how North Korea increased its revenue from illicit coal export by expanding its cargo fleet and engaging in direct delivery of the product to its customers in China in 2019 from 2018. The dramatic increase in the amount of coal exported from around 2 million tons to more than 5.5 million, an increase of 180%, was made possible by enlisting Chinese ocean-going barges. Unlike North Korean cargo vessels that have to rely on STS transfer of coal to avoid using port facilities, Chinese barges can travel back and forth between the coal export terminals in Songnim and Taean in North Korea and the deep interior of China by sailing up the Yangtze river. This has shortened the turnaround time for the vessels, thereby permitting greater volume of export over time.

Estimating North Korea’s Coal Export in 2018 and 2019:

Unlike the 2019 UN PoE report, which includes an estimate of the amount of coal that North Korea exported illegally throughout the year, the 2018 UN PoE report did not present such estimate for 2018. But the results of satellite tracking of bulk cargo ships that had anchored in North Korean ports, member states’ investigations into illicit coal export schemes, and Project Sandstone16 by the Royal United Services Institute for Defense and Security Studies (RUSI) important insights on the scale of North Korea’s illicit coal export, as well as providing the following key parameters: the average size and value of coal shipments, total cargo capacity of the ships involved, average number of trips made annually by the ships involved.

– The number of vessels involved: OFAC has issued an advisory in March of 2019 that lists the vessels that are thought to be involved in illicit coal trade with North Korea since August 5th 201717. There was a total of 49 ships with the combined deadweight tonnage of 482,177 metric tons.

– Average size of coal shipments can be inferred from the deadweight (cargo capacity) of the ships and how much of the ship’s cargo capacity was used in each shipment (loading rate18). Annexes 5-1 and 5-2 of the 2017 panel of experts report19 contains information regarding the size and value of 15 shipments. Based on this information, this study estimates the average loading rate to be 91%.

– Number of trips: an analysis by RUSI’s Project Sandstone20 of the voyages undertaken by a North Korean cargo vessel, Tae Yang (IMO 8306929), shows it took 23 days for the ship to sail a distance of 3,000 kilometers from Nampo, North Korea, to the Gulf of Tonkin in Southern China. This implies a roundtrip of approximately two months. In addition, the information contained in Annex 15 of the 2018 PoE report shows that the typical interval between ship’s loading of coal in North Korea and its unloading in the Gulf of Tonkin was between one and two months, implying an average turnaround time of two to four months. When annualized this would imply a maximum annual number of voyages of between three and six times.

– Adjusted price of coal consists of the prevailing market price adjusted by a discount factor. It is believed North Korean coal was sold at a steep discount in 2017 because of sanctions. In six instances of illicit coal export of which transaction information is known, North Koreans were paid on average USD $61.6 per ton. This figure represents a 30% discount from the average market price throughout 2017, which was approximately USD $8821. The “sanction discount” continued into 201822, but the case of Wise Honest23 shows the margin of discount may have improved to around 20% (see footnote), which is the number used in this study.

The product of the above parameters forms the upper bound of the estimate of North Korea’s total illicit coal export in 2018, which is as follows:

Substituting in the values estimated into the formula above, the revenue that North Korea could have earned from illicit coal export in 2018 ranges between USD $112 million ~ $225 million24 with the median value of USD $169 million.

The 2019 UN PoE report quotes the estimate provided by a member state25 that North Korea’s coal export was 3.7 million tons between January and August of 2019, which increases to 5.55 million tons when annualized. Although the report also quotes a revenue figure of USD $550 million, the actual value of North Korea’s coal export is likely to be significantly lower. The supplied estimate assumes an average market price of USD $100 per ton in 2019. In fact, the market price of coal throughout 2019 was around USD $78, and with the “sanction discount” in effect North Korea’s earnings could have been even lower. Adjusting the market price with the same discount factor of 0.8 as in 2018, North Korea’s coal revenue for 2019 is estimated at USD $346 million. The total revenue without adjusting for the discount factor is estimated at USD $433 million.

Other sanctions evasion activities:

In addition to STS transfer of refined oil and coal trade, the 2019 UN PoE report details North Korea’s other major sanctions evasion activities.

– Sand export: the 2019 panel of experts reported that an unidentified member state reported a substantial sand-export operation from the DPRK to China has been carried out since May 2019 with over 100 illicit shipments involving at least one million tons of sand worth USD $22 million.

– Fishing rights: North Korea has also continued to transfer fishing rights in violation of sanctions, which earned the country USD $120 million in 2018, according to an unnamed member state.

– Overseas workers: UN panel believes that there 2,000 North Koreans “recently entered China on visitor visas for the purpose of earning income”. In addition, it has been reported Russia has relocated some of the North Korean workers based in its territory to Abkhazia, a self-declared state that most countries recognize as part of the Republic of Georgia.

US Sanctions:

The maximum pressure campaign was premised on applying unprecedented pressure on North Korea’s economy, which is considered to be Pyongyang’s soft belly. As North Korea’s pace of provocations sped up, so did the sanctions measures. The trend in OFAC designations since 2005 shows that the US government started to apply unprecedented economic pressure on North Korea, especially since 2016 when North Korea was embarking on a two-year whirlwind campaign of nuclear tests and long-range ballistic missile launches. The number of new designations in 2016, 115, was in fact more than the cumulative number of the designations between 2005 and 2015, which totaled 109.

The pressure grew even more intense in subsequent years as Figure 2 shows. OFAC’s enforcement action in terms of the number of sanctioned entities, vessels/ aircrafts, and individuals reached the peak of 137 new designations in 2017. Despite the dramatic diplomatic breakthrough in 2018 that enabled the first ever summit between the leaders of United States and North Korea in Singapore, pressure was still kept on North Korea as OFAC designated additional 120 entities, individuals, and vessels in the same year.

Figure 2. US Treasury’s DPRK sanction designations: 2005-2020

Source: author’s analysis of OFAC SDN data

Source: author’s analysis of OFAC SDN data

But for reasons unclear the number of new designations dropped precipitously to 13 in 2019. It was not because of a dearth of targets, as this study has amply shown. The decrease was especially pronounced in vessel designations, which forms the critical link between North Korea’s struggling domestic economy and the rest of the world. OFAC, having designated 42 vessels in 2018, designated only one vessel, Shang Yuan Bao (see footnote 7) in 2019 for violations that had taken place a year before.

OFAC’s (in)action comes to even more stark relief when is compared to the UN PoE’s recommendation to sanction 10 foreign-flagged oil tankers26 for illicit transfer of refined oil, and two foreign-flagged cargo ships and two North Korean ships for their participation in the illicit coal trade27. None of ships that the Panel of Experts recommended for sanction has been designated either by the United States or UN Sanctions Committee on North Korea. The drop-off in vessel designations in 2019 capped a period of intense US focus on North Korea’s shipping, which had led to 101 vessel designations by 2018. In this context 2019 seems like the year that US government abandoned the effort to deal a severe blow to North Korea’s illicit trade.

Conclusion:

When it was conceived back in 2017, Trump administration’s “maximum pressure and engagement” campaign was arguably the most effective US policy on North Korea of the past decade. The urgency of North Korean provocations in 2017 and the administration’s willingness to pressure North Korea’s most important ally, China, finally enabled the international community to impose on North Korea sanctions strong enough to inflict serious damage to its economy. The prospect for even more restrictive sanctions may have been a factor behind North Korea’s sudden willingness to engage in dialogue with the United States in early 2018.

But three years later, the maximum pressure campaign is waning badly. As this study has shown, North Korea’s sanction violations have increased greatly throughout 2019. Abetted by China and Russia, North Korea was able to expand both the refined oil import and coal export, the latter being the most important source of hard currency for the regime today. The rapid escalation in illicit activities was made possible by dozens of foreign-flagged ships that joined North Korea’s dilapidated merchant fleet.

The lack of sanctions enforcement is strongly associated with the expansion of North Korea’s illicit activities. United States has essentially stopped sanctioning vessels that facilitate STS transfers of oil and coal, the critical lifeline for the North Korean economy. While the number of new OFAC designations dropped from 120 in 2018 to 13 in 2019, the number of newly designated vessels dropped from 42 to 1. In contrast, the 2019 UN Panel of Experts report recommended sanctioning 12 foreign-flagged and 2 North Korean ships for violating international sanctions.

The extraordinary gap between sanctions violations and enforcement strongly suggests that the Trump administration is no longer pursuing maximum pressure on North Korea. While one could argue that this suspension in enforcement is meant to give diplomacy a chance, no diplomatic breakthrough took place in 2019. Despite Trump administration’s silent concession, North Korea carried out 13 missile tests throughout the year, which involved short range and submarine launched ballistic missiles. Clearly, it is time to put pressure back on diplomacy with North Korea.

The views expressed herein do not necessarily reflect the views of the Asan Institute for Policy Studies.

- 1. UN Security Council “Final report of the Panel of Experts submitted pursuant to resolution 2464 (2019)” S/2020/151

- 2. UN Security Council “Final report of the Panel of Experts submitted pursuant to resolution 2407 (2018)” S/2019/171

- 3. Office of Foreign Assets Control, U.S. Department of Treasury, “Specially Designated Nationals and Blocked Persons List (SDN) Human Readable Lists” https://www.treasury.gov/resource-center/sanctions/sdn-list/pages/default.aspx

- 4. OFAC Advisory to the Maritime Petroleum Shipping Community “Updated Guidance on Addressing North Korea’s Illicit Shipping Practices” March 21, 2019

https://www.treasury.gov/resource-center/sanctions/Programs/Documents/syria_shipping_advisory_03252019.pdf - 5. When interpreting the graph, one should note that the observations do not represent the actual number of barrels, but rather estimations based on the reported cargo capacity (deadweight) published in the maritime databases. Strong linearity is therefore an artifact of the data that is composed of fixed observations. Nonetheless they serve as useful guidelines to estimate how much refined oil North Koreans may have been able to procure through the STS transfer scheme.

- 6. Paragraph 2, 2019 UN PoE report

- 7. The case of sanctioned Taiwanese oil tanker, Shang Yuan Bao (IMO: 8126070), shows that the assumption of 70% loading rate is realistic. According to OFAC, Shang Yuan Bao transferred 1.7 million liters of refined oil, or 1,504 tons, to a North Korean oil tanker, Paek Ma, sometime between April and May of 2018. The latter can carry up to 2,250 tons of cargo, which translates to approximately 67% loading rate. OFAC press release: https://home.treasury.gov/news/press-releases/sm762

- 8. United States Mission to the United Nations, “FACT SHEET: UN Security Council Resolution 2397 on North Korea”, December 22, 2017. https://usun.usmission.gov/fact-sheet-un-security-council-xresolution-2397-on-north-korea/

- 9. One of the two foreign-flagged ships, Wan Heng 11, was later reflagged as North Korea’s.

- 10. Paragraph 8, UNSCR 2321

- 11. Paragraph 11, UNSCR 2375

- 12. Paragraph 6, UNSCR 2397

- 13. https://www.eia.gov/todayinenergy/detail.php?id=31572

- 14. 2019 UN PoE report states that North Korea exported 3.7 million metric tons of coal between January and August, which translates to 5.55 million tons when annualized.

- 15. Paragraph 61, 2019 UN PoE report

- 16. https://rusi.org/project/project-sandstone

- 17. The paragraph in UN Security Council Resolution 2371 that banned the import of North Korean coal took effect on that date.

- 18. The ratio of shipment size to ship’s deadweight

- 19. UN Security Council “Final report of the Panel of Experts submitted pursuant to resolution 2345 (2017)” S/2018/171

- 20. https://rusi.org/project/project-sandstone

- 21. Royal United Services Institute for Defense and Security Studies (RUSI) “On the Trail of the Tae Yang: AIS Spoofing and North Korean Coal Smuggling” June 26, 2019

https://www.rusi.org/publication/other-publications/project-sandstone-3-trail-tae-yang-ais-spoofing-and-north-korean-coal?page=12 - 22. Paragraph 37, 2018 UN PoE report. The same report analyzes the case of Wise Honest (IMO: 8905490), which was caught exporting to Indonesia 26,000 metric tons of coal valued at USD $2,990,000 in April ’18. Although this implies an average price of USD $115 per ton, UN experts also found out that North Koreans had paid USD $760,000 to a local broker to facilitate the transaction. Adjusting for this “fee”, the average price per ton drops to USD $86, a discount of 20% from the prevailing market price in 2018. The payload also represents 93% of Wise Honest’s cargo capacity of 27,881 tons.

- 23. After being impounded by the Indonesian authorities the ship was later transferred to the US government, which is planning to auction off the ship and transfer the proceeds to Otto Warmbier’s parents. https://www.voanews.com/usa/us-marshals-sell-seized-north-korean-cargo-ship

- 24. Assumes a total amount between 1,316,343 – 2,632,686 tons at the average market price of USD $107, and with a discount factor of 0.8. The median value and amount are USD $169,018,468 and 1,975,515 tons, respectively

- 25. Most likely the United States

- 26. Paragraph 44, 2019 UN PoE report

- 27. Paragraph 45, 2019 UN PoE report

Facebook

Facebook Twitter

Twitter