Federico Gallo1

Believe Green

Chong Woo Kim, Research Fellow

The Asan Institute for Policy Studies

In January 2015, South Korea launched its new Emission Trading System (ETS), which is set to be the second largest after the EU ETS. However, this is unchartered territory and the need for carrying out thorough quantitative analyses to minimize risks and uncertainties surrounding the impacts of South Korea’s carbon trading scheme is emphasized. This Issue Brief explores both the opportunities and risks arising from this bold decision. It is suggested that South Korea is in a unique position to influence the low carbon and green agendas in both developing and developed countries. The country could exercise this influence in a number of ways. For example, it could proactively push for an ambitious global deal on climate change; also, could leverage the weight of its own carbon market to encourage the creation, growth and harmonization of regional carbon markets. However, it is noted that South Korea’s unique opportunity may be limited in time, as its influence could soon be reduced when China launches its national carbon markets in 2016.

Carbon markets: their history and development

The history of carbon markets formally begins in 1992, when the UN convened the Conference on Environment and Development in Rio de Janeiro, producing the Framework Convention on Climate Change (UNFCCC). Its 156 signatories declared their “concern that human activities have been substantially increasing the atmospheric concentrations of greenhouse gases … and may adversely affect natural ecosystems and humankind”. The Convention established an international framework within which it would be possible to limit anthropogenic greenhouse gas emissions. It also demanded that “policies and measures to deal with climate change should be cost-effective so as to ensure global benefits at the lowest possible cost”.2

Looking at developed countries to spearhead this cause, the Kyoto Protocol was signed in 1997 to reduce greenhouse gas emissions by 5.2% compared to 1990 levels. One of the important clauses of the Protocol was the inclusion of ‘flexible mechanisms’, whereby countries were allowed to meet part of their emission reduction commitments by purchasing carbon credits. This established the possibility for a carbon market. The protocol became legally binding in 2005 and in the same year the EU Emissions Trading Scheme became operational and remains to this day the largest carbon market in the world.

The Kyoto Protocol had a number of intrinsic weaknesses. Chiefly, the United States never ratified its participation to it. Also, it did not require legally binding actions from countries like China, which would shortly become the world’s largest emitter. These intrinsic weaknesses, combined with the financial crisis of 2007-2008, have led to several years of slower progress at the international negotiations on climate change. The complexities of bringing together almost 200 countries, combined with the difficulties of dealing with the effects of the financial crisis have made it increasingly harder to achieve a ‘Top Down’ global treaty to tackle climate change. This political uncertainty did also have direct impacts on existing carbon markets, with the EU ETS price falling to a fraction of its pre-crisis peak. Despite the difficulty of signing a global treaty, momentum has been building in the opposite, ‘Bottom Up’ direction. Individuals, companies and subnational governments have been pushing for carbon emissions to be brought under control. More concretely, a number of separate carbon markets are being created around the world and some of them are beginning to be linked.

At the climate meeting in Durban in 2011, all parties to the UNFCCC agreed to sign a “new and universal greenhouse gas reduction protocol, legal instrument or other outcome with legal force by 2015 for the period beyond 2020”.

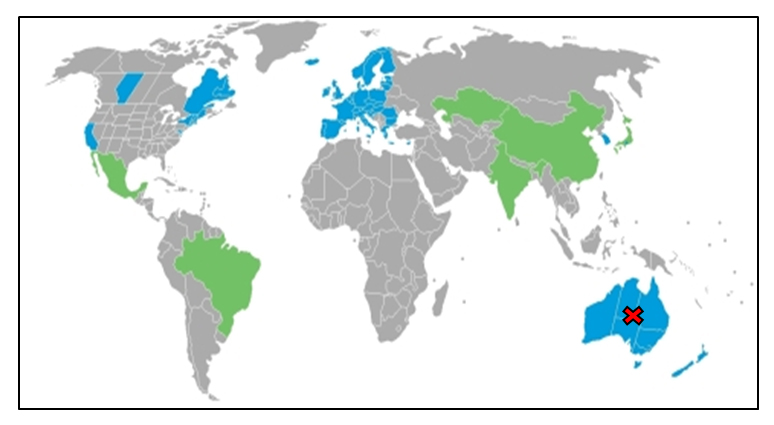

Even as the outcome of the international climate discussions remains unclear, policymakers in a growing number of countries are adopting and implementing market-based measures to limit carbon pollution. Fig. 1 displays the carbon markets worldwide that already exist (blue) with the exception of Australia or are under development (green). These include the European Union Emissions Trading System (EU ETS), the Quebec Cap-and-Trade System (2013), the Regional Greenhouse Gas Initiative (RGGI) in the Northeastern United States, the California Emissions Trading System (CA ETS, which conducted its first auction in November 2012), and South Korea’s Emissions Trading System (Korean ETS) launched in early 2015. China has also been running a pilot scheme in 7 different regions. On a negative note, the Australian Emissions Trading System was scrapped with the election of a new government.

Figure 1. Map of the World’s Carbon Markets

Source: IETA

Each system contains distinguishing features, including a target for emissions reductions, its scope and coverage, the auction format etc. Detailed information for each system has been collated by IETA3. There are many reasons to expect that more carbon markets will spring up around the world in the coming years and that they will be gradually linked to one another.

South Korea’s carbon market

In 2008, South Korean President Lee Myung-Bak declared “low carbon, green growth” as a new national strategy to fuel future economic growth. Since the end of the Korean War in 1953, South Korea has achieved remarkable economic growth transforming itself into an industrialized country. But this economic growth comes at a cost: environmental pollution. The country’s economy has become dependent on heavy industries such as steel, oil refineries and chemicals with emissions of CO2 per capita rapidly increasing by 115.4% between 1990 and 20104. In 2011, it ranked seventh among the top CO2 emitting countries after China, the United States, India, Russia, Japan and Germany5. With evidence for global warming mounting, the South Korean government passed the Framework Act on Low Carbon Green Growth to enhance the transition from brown to green economy in 2010 and, thereby, promoting investment and job creation in clean technology and renewable energy. The national assembly passed the bill unanimously for a Cap-and-Trade system for emissions in 2012. The Korean ETS (Emissions Trading system) modeled on the EU ETS has gone into operation at the Busan headquarters of the Korea Exchange in January 2015 with the country’s 525 largest emitters participating in curbing their GHG (Greenhouse Gas) emissions. The scheme will run in three phases with Phase I (2015~2017), Phase II (2018~2020) and Phase III (2021~2026) and hopefully reduce South Korea’s emissions by 30% below the BAU6 level by 2020. These emitters are targeted either because they are companies annually producing over 125,000 tCO2 and/or they are workplaces annually producing over 25,000 tCO2. In Phase I, 100% of their emissions allowances are given for free, but this will reduce to 97% in Phase II and to 90% in Phase III with the remainders being auctioned off. For more on the scheme, see, for instance, IETA’s case study guide7 to emissions trading in South Korea where such concepts as banking, borrowing and offsets are clearly explained.

In total, 1.598 billion Korean Allowance Units (KAU) have been allocated to the country’s largest 525 emitters in Phase I with 89 extra million KAUs set aside for backups. Here, 1 KAU is equivalent to 1 tCO2. The Federation of Korean Industries (FKI) is urging the government to re-calculate allowances saying that their current allowances are under-estimated and that the scheme will cost them KRW27.5 trillion in Phase I.8 The FKI believes the allowances are approximately 20% less than what is needed. The cap on CO2 was relaxed back in September 2014 when an additional 58 million tons CO2 were added to the government’s original target for Phase I and, hence, sending a signal that it is already reneging on the green pledges adopted by the previous government.

Taking risks – positive and negative aspects

South Korea has made a bold move in setting up its national carbon market. What will be the implications? What will be the advantages and disadvantages and, more importantly, what are the options moving forward? The country has undoubtedly made a decision that carries some risk. However, risk has a positive side to it: the possibility of reward. The downside and upside of South Korea’s decision can be summarized as follows:

• Competitiveness concerns. One of the main risks is that the carbon market and the associated carbon emissions reduction target could affect competitiveness. Indeed, this is a major concern for industries as the Cap-and-Trade system would add costs to their businesses in difficult times. Such additional costs could affect exports, as South Korean businesses may find themselves at a disadvantage against business from countries without carbon targets.

• Early mover advantages. On the other hand, taking early action against climate change could bring a significant early mover advantage to the country and its industries. An example of such positive impacts comes from the UK. Since the enactment of the Climate Change Act in 2008, evidence shows that the UK’s LCEGS (Low Carbon Environmental Goods and Services) sales grew by 4.8% in 2011/129 when the UK’s overall economic growth was nearly flat in the aftermath of financial crisis. The country ranked 6th in the world in terms of LCEGS sales. As for South Korea, it ranked 13th with the LCEGS growth rate at 5.8% for the same period, and the figures suggest that this sector could become a real engine of growth. It can give a further boost to quality job creation in innovative green technologies when combined with the traditionally strong IT/ICT sectors. This is one area where President Park Geun-hye’s vision for a creative economy can really prosper. It is clear that products that are environmentally polluting are likely to see their markets shrink or the products penalized in future. The EU has already introduced legislation to set mandatory emission reduction targets for new cars10. The legislation requires a 40% CO2 emission reduction to be achieved by the fleet average of all new cars an automobile manufacturer produces in 2021 relative to the 2007 fleet average. This trend will go beyond the motor industry and hence early adopters of green technology will have a strong competitive edge.

Whether the competitiveness issues or the early mover advantages would dominate will depend on the global context in the coming years. In particular, two factors will play a crucial role:

• The global environment. If human activities continue to negatively impact our atmosphere and natural resources, then those countries that took early action would have a double advantage. First, they would be better adapted, for example by requiring less energy from fossil fuels or other raw materials. Second, they will have a competitive edge, and will be able to also export expertise, services and technologies to help other countries move to a low carbon economy. The future is uncertain, but the trend is clear: a growing population that is increasingly prosperous imposes more demands on an already strained planet. So the likelihood is that the global environment will increasingly favor those economies that are more sustainable.

• The global attitudes towards environmental challenges. From an economic perspective, competiveness depends on what your competitors are doing. If no other country is implementing low carbon policies, then South Korea would be at a disadvantage. On the other hand, if other countries also act to tackle climate change, the disadvantage disappears. As mentioned above, the trend is that countries are increasingly implementing carbon management policies.

South Korea’s options

A crucial positive aspect of taking risks in business is that we can work hard to influence events and maximize our chances of success. Now that South Korea has created its carbon market, it does not have to wait and see what the rest of the world does, and hope that things go in its favor. The country has an opportunity to build on the considerable credibility that it has gained, proactively push for more ambitious carbon mitigations targets across the world and for more uniformed carbon market rules. Pursuing this agenda could lead to two important consequences: that the competitiveness issue can be minimized, and the early mover advantage can be maximized.

Concretely, South Korea has an opportunity to pursue this agenda on two complementary fronts:

• Top down. South Korea should put all its energies towards boosting the chances of a successful global agreement to tackle climate change under the auspices of the UNFCCC. The opportunity is that the world has agreed to sign such a document in Paris in December of 2015. South Korea should leverage its considerable credibility: it is host to the Green Climate Fund and it is a country at the interface of developed and developing countries, and thus can be trusted by all. South Korea should use this opportunity also to boost its international standing as a match-maker. South Korea as a middle power can act as an intermediary between developed and developing countries. Leveraging the fact that it has hosted the Headquarter of the Green Climate Fund in Songdo, it is in a good position to explore any linkage between the Green Climate Fund and carbon markets. Mexico, another middle power, played a prominent role back in 2009 and their efforts resulted in the creation of the Green Climate Fund. By allowing developing countries to sell carbon credits into South Korea’s market, the country can enhance its image abroad especially among developing countries, and this will in turn promote sustainable development and green growth. South Korea could also start with a small pilot scheme, whereby it initially allows only small volumes of carbon credits from specific markets (for example, voluntary carbon credits associated to sustainable development, e.g. in Africa).

• Bottom up. In parallel to the above, South Korea has also a unique opportunity to catalyze the current trends in the creation and linkage of carbon markets. With the second largest carbon market in the world, and arguably more flexible than that of the EU ETS, South Korea has a powerful leverage. For example, it could offer smaller markets to join the Korean ETS. In particular, it could do it strategically. For example, it could link up with markets with cheaper credits to lower its mitigations costs. Alternatively, it could join a market where credits are more expensive, thus creating an export market for its carbon credits.

In order to minimize risks, South Korea could use a gradual approach. For example, it could run pilot linkages with the smallest markets, or with specific sectors or even types of projects.

South Korea can become the ‘leader’ among regional carbon markets. It has a short window of opportunity to take a leading role in accelerating the emergence of carbon markets worldwide. Its domestic market is currently the second largest after the EU, but it is much more agile (the EU needs to reach a consensus among 28 countries). However, this window of opportunity is likely to close fast: China will soon open its national carbon market, which will dwarf South Korea’s. So South Korea could potentially use its current weight to help accelerate the adoption and linkage of various carbon markets around the world. It is important to note that the disadvantage currently perceived by South Korean industry exists only if no other country has a carbon market: if many countries start adopting carbon markets, then South Korea actually would be in a privileged position with an ‘early adopter’ advantage.

At present, the government has not specified when its carbon market will be linked to other markets around the world. As the scheme is in its early phase, it is prudent to observe the market to ensure it is functioning as it intended and to iron out any problems that may arise. But with its energy intensive industries, it will be in South Korea’s interest to join other carbon markets to reduce the cost of carbon mitigation. A study by Ellerman and Decaux11 has demonstrated using marginal abatement cost curves how two carbon markets in different regions of the world can both benefit when allowed to trade freely.

Analyzing the details of such scenarios goes beyond the scope of this Issue Brief. However, the above reasoning suggests that more rigorous, quantitative and evidence-based analysis should be carried to explore these questions which are of fundamental importance both for South Korea’s economy and its standing in the world, especially if it seeks to have a geopolitical influence commensurate to the success of its economy over the past several decades.

Conclusions

This Issue Brief explored a number of issues around South Korea’s bold decision to create the second largest carbon market in the world. We discussed how this carries considerable risks, such as to the competitiveness of its industries, but also significant opportunities, including being an early mover in the fast growing sector of low carbon and green sustainable growth.

We also saw how the success or failure of South Korea’s environmental strategy will depend on the decisions made by the rest of the world. Crucially, it was argued that South Korea not only can influence the decisions of other countries, but is in a unique position to do so. This is due to its credibility among developed and developing nations, both on purely economic terms and in the context of fighting climate change.

In terms of the actions that South Korea can take to influence the international action against climate change, we began to explore some concrete options, including pushing for an ambitious global deal on climate change under the aegis of the UNFCCC as well as incentivizing the creation and expansion of regional carbon markets by leveraging the size of its own emissions trading system, the second largest in the world, by offering potential linkages to it. It must also pursue a consistent policy to facilitate green growth and not deviating from it for short-term gain.

Due to space constrains we were not able to carry out a fully-fledged analysis of the various options, so one key recommendation of this paper is that South Korean decision-makers should have these options analyzed and quantified to draw upon a concrete set of policy recommendations bearing in mind that this is a new and difficult area of research.

South Korea has a unique opportunity to influence its destiny, but the drawback is that it may only have a short window of time: In 2016, China plans to launch its national carbon markets based on the experience gained from running its seven regional carbon market pilots. This will dwarf South Korea’s carbon market and hence reduce the country’s ability to influence the burgeoning climate and low carbon economy.

The views expressed herein do not necessarily reflect the views of the Asan Institute for Policy Studies.

- 1.

Contact email: federico@believegreen.org, Web address: www.believegreen.org

- 2.

- 3.

- 4.

Energy Policies of IEA Countries, The Republic of Korea, 2012 Review. International Energy Agency (2012).

- 5.

CO2 Emissions from Fuel Combustion, Highlights, International Energy Agency (2013).

- 6.

BAU: Business As Usual

- 7.

South Korea The World’s Carbon Markets: A Case Study Guide to Emissions Trading (2013) http://www.ieta.org/assets/EDFCaseStudyMarch2014/south%20korea%20ets%20case%20study%20march%202014.pdf

- 8.

- 9.

- 10.

European Commission, Reducing CO2 emissions from passenger cars.

http://ec.europa.eu/clima/policies/transport/vehicles/cars/index_en.htm - 11.

Ellerman, D. and Decaux, A. Analysis of post-Kyoto CO2 emissions trading using marginal abatement curves, MIT EPPR, report number 40 (1998)

Facebook

Facebook Twitter

Twitter