Introduction

The Chinese government has recommended to North Korea since the 1980s that it adopt the Chinese style of economic reform and open-up policy. From the Chinese perspective, the adoption would increase North Korea’s economic development and independence. Not only would it eventually bring stability to the Kim Jong-un regime, but China would also significantly benefit economically by having full access to shorter international trade routes across North Korea. This article considers a role this “distance” factor can play in boosting China’s trade with South Korea, the United States, and Japan.

Kim Jong-un succeeded his father at the end of 2011, set out to provide better living conditions for his people, and never to have them need to tighten their belts again.1 This will be very difficult to achieve without full support from the international community. North Korea can only expect to receive this full support to rebuild its economy when it abandons its nuclear program and becomes a responsible member of the international community.

Recently, North Korea’s economy has become far too dependent on China. China makes up nearly 90 percent of North Korea’s trade with the outside world. Most of North Korea’s energy, including oil, resources, and household products come from China. It is inevitable that North Korea will, one day, have to accept a Chinese style economic reform and open-up policy to invigorate its economy. Other alternatives would prolong its isolation, and lead to an eventual collapse of North Korea’s economy. The opening up of North Korea will bring better prospects for China than the one it may face with a potentially nuclear-armed North Korea.

Economic Benefits: The Distance Effect

It is important to determine how significantly the opening up of North Korea would boost the economy of China’s northeast provinces, which are home to almost 110 million people. If this occurs, the three provinces of Liaoning, Jilin, and Heilongjiang will have easy access to the existing ports and perhaps new ones on the east side of North Korea. This will open up sea routes via the Pacific Ocean giving direct access to the United States and Japan rather than having to detour on land via the regional hub port of Dalian, and sail around the Korean Peninsula. Direct trade between the three provinces and South Korea will be possible by going across North Korea.

Figure 1: Northeast China, South, North Korea and Japan

Source: Google Earth

Geographically, Liaoning and Jilin provinces have direct borders with North Korea, whereas Heilongjiang province only has a border with Russia (see Figure 1). Also, Jilin and Heilongjiang provinces are currently landlocked. In 2011, a ship setting off from the port city of Najin in North Korea transported coal to Shanghai for the first time. This led the energy-hungry southeast region of China to benefiting from importing minerals such as coal from the mineral rich northeast region of China via Najin, and importing directly from North Korea. Moreover, the northeast region of China could rapidly grow its economy by transporting its minerals not only to fuel China’s economy but also to export them abroad. In November 2009, the State Council of the People’s Republic of China declared plans to develop Changchun-Jilin-Tumen as a pilot economic zone. These plans are central to reinvigorating the neglected economy of northeast China, which was once home to China’s petro-chemical industry. The YTN news agency reported in 2010 that China had signed a contract with North Korea to have exclusive rights to use dockyards four, five, and six at the port city of Najin for the next 50 years in addition to dockyard one.2 Such economic cooperation mutually benefits both China and North Korea.

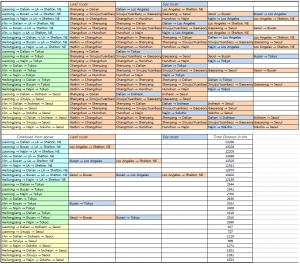

In this section, economic benefits are worked out assuming free movement of goods across the China-North Korea-South Korea borders. The focus was on measuring approximately the extent trade will increase due to shortening of international trade routes, such as through the ice-free port of Najin or Sinuiju. Using Google Earth Pro, several trade routes originating from the capital city of Liaoning (Shenyang), Jilin (Changchun), and Heilongjiang (Harbin) provinces to Seoul, Tokyo, and Shelton (Nebraska, USA) were identified, and where possible, existing road distances were worked out rather than geodesic distances. Shelton was chosen as the halfway point between Los Angeles and New York, which are the two most populous cities in the United States. Only in cases where stretches of existing roads were not identifiable did we use geodesic distances. The geodesic distance is only used in a couple of cases such as in between Hunchun and Najin, where the leg of journey only accounts for a small proportion of the total distance travelled. For distances at sea, the sea-distances company website was referred to,3 and nautical miles were converted to its equivalent in kilometers between seaports. Obviously, the website did not provide the nautical distance between Najin and Los Angeles as there is no trade between these ports. In this case, the nautical distance between Vladivostok and Los Angeles provided by the website was used, and then adjusted for Najin using simple geometry. Table 1 shows trade routes that were considered, and the “land route” refers to a road route. The first row, for example, shows the Liaoning-Dalian-LA-Shelton route, and the columns beside it show specific stretches of roads taken along the way. The last column has the total distance between Liaoning (Shenyang) and Shelton, including the distance at sea.

Table 1: International Trade Routes from Heilongjiang, Jilin, Liaoning to Seoul, Tokyo, Shelton NE

Source: Google Earth and sea-distances.com

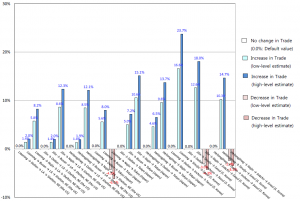

Figure 2 shows a range of percentage changes, low and high-level estimates, in trade relative to the respective Dalian route in China. Dalian is the major port city in Liaoning province. In working out the expected changes in trade, they are based on estimates of the gravity model on the distance effect that a 1 percent increase in the distance between two countries is associated with a decrease in the trade of 0.7 percent (low-level estimate) to 1 percent (high-level estimate) between those countries.4 This partly reflects increased costs of transportation, and a less tangible fact that trade tends to be intense when countries have close personal contact, and this contact tends to diminish when distances are large.

Figure 2: % Changes in Trade relative to the Dalian Route

Each route via Dalian has been taken as default and compared to other possible routes with the same destination. For instance, there are three routes to Shelton from Liaoning. The default route is Liaoning-Dalian-LA-Shelton with 0.0 percent denoting no change in trade.

To its right is the Liaoning-Busan-LA-Shelton route with low-level (1.4%) and high-level (2.0%) estimates of expected changes in trade. These are expected increases in trade had the shorter Liaoning-Busan-LA-Shelton route been taken instead of the default Liaoning-Dalian-LA-Shelton route. It also shows a substantial increase of 23.7 percent expected for the Liaoning-Sinuiju-Seoul route compared to the default Liaoning-Dalian-Incheon-Seoul route. The Jilin-Sinuiju-Seoul route will also boost trade as much as 18.0 percent. Thus, it is evident that all the countries have much to gain (as indicated in bluish color) when traversing through North Korea on shorter international trade routes. However, some routes such as the Liaoning-Najin-Tokyo route is longer than the default Liaoning-Dalian-Tokyo route, and this would result in decreasing trade (as indicated in reddish color). Also, it is noted that for shipping goods to Tokyo and to Shelton from Harbin, the routes via Vladivostok are, in fact, shorter by 9.4 percent and 1.9 percent, respectively, compared to Najin.

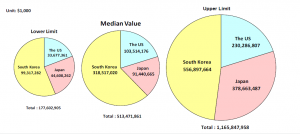

Figure 3: Cumulative Economic Benefits from the Distance Effect between China’s northeast provinces and South Korea, the US and Japan from 2015 to 2030.

Source: Korea International Trade Association

Figure 3 shows the cumulative economic benefits to China’s northeast provinces from the distance effect in trade with South Korea, the United States, and Japan from 2015 to 2030. It is assumed that the distance effect comes into play in 2015, and high-level estimates in Figure 2 have been used. The median values are chosen, based on historic data from 1998 to 2012, to work out future annual growth rates in trade between each of Liaoning, Jilin, Heilongjiang provinces and South Korea, the United States, and Japan. Basically, economic benefits with the distance effect are subtracted from the ones without for each year beginning in 2015 and ending in 2030. The cumulative economic benefits for the 16-year period amount to USD 513 billion. A 95% confidence interval of the future annual growth rate (in median) in trade is obtained for each of these 9 trading pairs (e.g., Liaoning-South Korea, Liaoning-the US and so on), and the lower and upper limits are then determined based on these growth rates in trade. In monetary units, these respectively correspond to USD 178 billion and USD 1.17 trillion. Simply speaking, the median value of USD 513 billion is the additional amount in trade expected to be generated in China’s northeast provinces purely from the distance effect for the 16-year period in consideration.

China-Vietnam

Trade patterns between Vietnam and China’s neighboring provinces to Vietnam were chosen for the purpose of comparison. Yunnan and Guangxi Zhuangzu provinces have borders with Vietnam. Guangdong province, with the highest Gross Regional Domestic Product (GRDP), is situated not far from Vietnam, as shown in Figure 4.

Figure 4: Map of China’s neighboring provinces to North Korea and Vietnam

Source: Google Earth

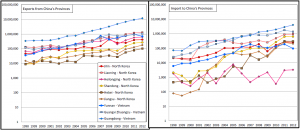

Figure 5 shows exports and imports in USD between China’s provinces and their neighboring countries—North Korea and Vietnam. It can be observed that trade for Guangdong-Vietnam is much larger than that of Yunnan-Vietnam or Guangxi Zhuangzu-Vietnam because of Guangdong province’s sheer size of economy.5 It has far exceeded those of others. North Korea’s trade with China is low relative to that of Vietnam even though there has been an upward trend.

Figure 5: Exports and Imports for China’s Provinces (Unit: $1,000 in log-scale)

Source: Korea International Trade Association

The Guangdong’s GRDP in 2011 was just over USD 820 billion, and this is about 1.3 times the combined GRDP of Shandong and Hebei.

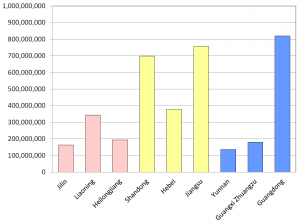

Figure 6: Gross Regional Domestic Product in 2011 (Unit: $1,000)

Source: National Bureau of Statistics of China

Figure 6 has GRDPs for China’s nine provinces.6 A simplistic analogy shows that Shandong and Hebei provinces should be exporting 10.3 times as much to North Korea, factoring in North Korea’s population, and assuming it is at a similar stage of economic development as Vietnam in 2011. It is very likely that, with the opening up of North Korea, its trade with economically bigger Shandong, Hebei, and Jiangsu provinces will grow faster, and can exceed those of Liaoning, Jilin, and Heilongjiang provinces.

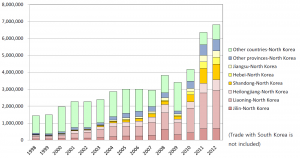

Figure 7: North Korea’s trade with China and other countries (Unit: $1,000)

Source: Korea International Trade Association and Korean Statistical Information Service

Figure 7 shows North Korea’s growing trade with Shandong, Hebei and Jiangsu provinces, and if recent trends continue, these three provinces can easily make up half the trade between China and North Korea within a decade7. In 2012, just over 87 percent of both North Korea’s exports and imports were with China, which is indicative of its growing dependency on China for trade. Nearly 90 percent of trade between China and North Korea was with the six provinces shown, and within these, 42.7 percent was with Liaoning province, and Shandong, Hebei, and Jiangsu provinces made up about 32.3 percent.

With the development of Changchun-Jilin-Tumen economic zone, Jilin province will certainly improve its share of trade with North Korea in coming years. Its GRDP growth rate of 13.4 percent in 2012 was higher than China’s GDP growth rate of 10.1 percent.8

Conclusion

It is very likely that the opening up of North Korea will allow access to shorter international trade routes from China’s Liaoning, Jilin, and Heilongjiang provinces through North Korea’s territory directly connecting with the Pacific Ocean and South Korea. Figure 6 shows that Jilin and Heilongjiang provinces are lagging behind Liaoning province which has the advantage of having the port city of Dalian. These two landlocked provinces and Inner Mongolia, though not considered here, can benefit when North Korea fully opens up. China only has limited access to the port of Najin at present, but full access to other shorter trade routes will reduce some of the burdens on the port of Dalian. Therefore, it is evident that China’s northeast provinces will much benefit from having access to shorter international trade routes that will increase trade with South Korea, the United States, and Japan. This will address a disparity that exists between China’s rich South and poor North.

North Korea is geographically surrounded by some of the largest countries in terms of trade—China, South Korea, Japan, and Russia—which are listed among the 10 largest exporting countries in the world.9 The gravity model of international trade suggests that two driving factors of bilateral trade between countries are its distance and the size of their respective economies. Already fulfilling one of the two factors or both, all the countries, including North Korea, have much to gain from its economic reform if it strictly adheres to international standards. In 2009, trade between China and North Korea shrank with the approval of UN sanctions over North Korea’s nuclear test, as clearly shown in Figure 7. The destabilizing effect of North Korea’s nuclear programs must be resolved first as a necessary step towards peace and cooperation in Northeast Asia. It is essential for North Korea to gain the confidence and trust of other countries. It is in the region’s interest to see a nuclear-free North Korea, to encourage North Korea to pursue a path towards adopting a Chinese style economic reform and open-up policy, and realize for all a thriving economy in this part of the world.

I would like to acknowledge and thank Mr. J. Y. Choo for his help with data collection and working out distances and Miss H. S. Lee for proof-reading.

The views expressed herein do not necessarily reflect the views of the Asan Institute for Policy Studies.

- 1

Kim Jong-un’s official speech commemorating the one-hundred-year anniversary of the birth of Kim Il Sung on April 15, 2012.

- 2

YTN News Report, 2010, http://www.ytn.co.kr/_ln/0101_201012261331466277.

- 3

Sea Distance Voyage Calculator, http://sea-distances.com/.

- 4

Paul Krugman, Maurice Obstfeld, Marc Melitz, International Economics: Theory and Policy (Upper Saddle River, NJ: Prentice Hall, 2011).

- 5

Korea International Trade Association, http://www.kita.net/.

- 6

National Bureau of Statistics of China, http://www.stats.gov.cn/english/.

- 7

Korean Statistical Information Service, http://kosis.kr/.

- 8

Consulate General of the United States, Shenyang, China, “Overview of Jilin Province,” http://shenyang.usembassy-china.org.cn/jilin.html.

- 9

CIA World Factbook, “Country Comparison: Exports,”

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2078rank.html.

Facebook

Facebook Twitter

Twitter