Credit: Alfred T. Palmer, “Assembling B-25 bombers at North American Aviation, Kansas City,” U.S. Library of Congress (1942), Repository: Library of Congress, Farm Security Administration – Office of War Information Collection 12002-38 (DLC) 93845501, https://loc.gov/pictures/resource/fsac.1a35291.

Introduction

South Korea’s global defense industry ambitions appear to be approaching a fork in the road. One path leads toward a future in which the country’s much-hyped ‘K-defense industry’ becomes a leader in the global arms trade reminiscent of South Korea’s successful dominance of industries such as semiconductors, automobiles, ships, and electronic goods. The Yoon Suk Yeol administration has ambitious plans to make Korea the world’s fourth largest arms exporter by 2027 based on the successful awarding of major defense procurement contracts to countries such as Poland, Australia, Saudi Arabia, and the UAE.1 In this future, South Korea achieves its quest for self-reliance and competes with European and U.S. defense firms in the global arms trade.

The second path leads toward a different future in which South Korea becomes an integral member of a U.S.-led federated defense industrial enterprise.2 For example, the November 2023 Defense Vision of the ROK-U.S. Alliance which will guide bilateral security cooperation for the next 30 years commits the two countries to “optimize defense industrial cooperation and supply chain resiliency.”3 The two countries have already signed a Security of Supply Agreement (SOSA) to ensure the priority delivery of defense-related orders and are finalizing a Reciprocal Defense Procurement (RDP) that will make it easier to buy and sell military capabilities with each other in what some describe as akin to a “defense industry free trade agreement.”4 The ROK has also expressed interest in participating in the AUKUS partnership’s Pillar Two cooperation on advanced defense technologies together with Australia, the United Kingdom, and the United States.5 In this future, South Korea becomes a key partner within a U.S.-led allied defense industrial base.

These two paths are not mutually exclusive. After all, some of the United States’ most important European allies have globally competitive defense firms of their own. But the rapid development and transformation of South Korea’s defense industry only 50 years since its inception presents a new task for the ROK-U.S. alliance to navigate. A history of distrust hangs over the alliance, holding it back from reaching its full potential in harnessing the defense innovation and manufacturing heft of the two countries.

This Issue Brief examines how the ROK and United States can successfully manage this new era of closer defense industrial cooperation by reciprocating trust and reconciling ambitions. The Issue Brief proceeds as follows. First, it reviews how U.S. attitudes towards defense industrial cooperation with allies and partners are changing. Second, it explains the valuable potential of closer ROK-U.S. defense industry cooperation. Third, it identifies differing objectives in their approaches to defense industrial cooperation. Fourth, this Issue Brief concludes by canvassing possible strategies to reduce the tension between self-reliance and alliance integration in the defense industry sector, including a clearer division of labor, a proof-of-life feasibility initiative, and learning from successful examples from other allies.

1. Federating Allied Defense Industrial Bases

Historically, U.S. allies like the ROK were mostly beneficiaries of U.S. global defense industrial primacy. The United States won the Second World War against Nazi Germany and Imperial Japan by outproducing both adversaries in armaments. It similarly defeated the Soviet Union thanks to its superior defense industrial base (DIB) which could offset Soviet quantity for superior technological quality.6 Allies and partners were mostly marginal players in these superpower arms races, offering niche contributions but lacking the military-industrial complexes.

Today, the situation is entirely different. This is due to at least five factors. Most importantly, China’s military modernization means that it now has the advantage against U.S. forces in the Western Pacific.7 China’s fleet outnumbers the United States, and China is increasing its shipbuilding capabilities for all naval classes.8 Second, Russia is resurgent as a major military threat following its invasions of Ukraine. It has “fully reconstituted” its military forces after two years of fighting and its defense industrial base is out-producing all of Europe on key munitions.9 Third, North Korea’s nuclear weapons threats and Iran’s military adventurism throughout the Middle East have further undermined confidence in the ability of the United States to fulfill orders for defense articles in a timely manner as part of the Foreign Military Sales (FMS) program. Fourth, defense industrial cooperation amongst these authoritarian regimes presents a new cross-regional challenge, such as the transfer of North Korean ballistic missiles and three million artillery shells and as well as Iranian drones to Russian forces in Ukraine.10 Finally, the U.S. DIB is struggling to meet the growing demand for production, both from the U.S. military as well as orders from allies and partners.11

In response, some U.S. experts have called for a “great awakening” in U.S. defense industrial strategy.12 The Trump and Biden administrations have actively moved to harness the defense industrial capabilities of U.S. allies. This has included removing outdated restrictions and export controls, authorizing unprecedented defense technology transfers, and linking together allies into minilateral coalitions.13 U.S. allies have unique defense technologies, manufacturing capacities, and geographic access that can supplement and accelerate the revitalization of the U.S. DIB, especially in the Indo-Pacific region.

For example, Australia has taken unprecedented steps to deepen defense industrial cooperation with the United States. The 2021 announcement that Australia would acquire a fleet of conventionally armed, nuclear-powered submarines as part of the AUKUS partnership with the United States and the United Kingdom reflects a profound shift in U.S. attitudes towards DIB cooperation with allies.14 Naval nuclear propulsion technology has long been considered one of the “crown jewels” of the United States, which refused to share this technology with other allies. For its part, Australia has granted substantial access for U.S. forces to rotate through Australia including submarines and long-range bombers, enacted tougher export control legislation, and contributed US$ 3 billion in funding to the U.S. submarine industrial base to help meet necessary production targets. In return, Australia is expected to purchase and receive the first of at least three Virginia-class attack submarines in 2032.15

Japan has similarly broken longstanding taboos on the export of defense articles. The April 2024 U.S.-Japan Joint Leaders’ Statement included the launch of a new Forum on Defense Industrial Cooperation, Acquisition and Sustainment (DICAS), as the United States and Japan look to undertake co-development and co-production of new capabilities such as missiles and missile defense.16 The Biden administration has further signaled its desire to cooperate with Japan on co-sustainment of U.S. Navy ships and U.S. Air Force aircraft at Japanese commercial facilities.17

An important part of any successful U.S.-led collective defense industrial enterprise will be the ROK. However, U.S. defense industrial cooperation with Australia and Japan has been enabled by at least two factors that do not apply in the ROK case. In Australia’s case, its defense industry ecosystem is dominated by multinational defense firms, predominantly from the United States and Europe. As such, Australia does not have large, export-oriented national defense firms who might compete with the United States. Japan has historically also not been a defense industry export competitor because of its legal restrictions on arms exports.18 Furthermore, Australia and Japan have clearly aligned threat perceptions of China with the United States whereas the ROK remains primarily focused on North Korea and acquiring military capabilities for a Korean Peninsula conflict.

2. Reciprocating Trust to Sign a Defense FTA

The ROK and the United States nonetheless both recognize the potential value of closer DIB cooperation. Starting from the late 1970s, the ROK and the United States first launched the Security Cooperation Committee (SCC) and started discussing arms transfers between the two countries. In the late 1980s, the Defense Technology and Industrial Cooperation Committee (DTICC) was established and began joint research projects. The two countries’ defense industry associations have had regular dialogues since 1993 as part of the Defense Industry Consultative Committee (DICC). Most recently, the 24th Korea-U.S. Integrated Defense Dialogue (KIDD) in April 2024 stated that, “The two sides agreed that cooperation to develop advanced technologies also supports shared efforts to enhance the defense industrial base of both the United States and the ROK, respectively.”19

There is therefore a well-established institutional architecture for discussing defense industrial issues, and yet bilateral cooperation has lagged significantly behind other U.S. allies. The ROK and the United States are already cooperating on some aspects of defense industry, including robots, aerospace, and advanced aircraft.20 Under the Yoon administration, the ROK has sought to conclude several agreements to bolster DIB cooperation. First, the Security of Supply Arrangement (SOSA) was signed in November 2023 to allow requests for priority delivery of defense-related orders from each other. The SOSA Statement between two countries clearly sets out that “each participant intends to provide reciprocal priorities support.”21 The SOSA addresses the supply chain risks associated with single-source suppliers for key weapons components or materials as well as challenges with re-stocking stockpiles depleted that were provided to other U.S. partners such as Ukraine or Israel.22

The second policy is the potential signing of a Reciprocal Defense Procurement (RDP) Agreement.23 Often described as the equivalent of a “defense industry free trade agreement,” an RDP reduces barriers to arms transfers and co-development and co-production of military capabilities. It also promotes reciprocity and an “equitable” balance of procurement and equal bidding opportunities for businesses from both countries. For example, the RDP agreement between the United States and Australia states that it will “reduce barriers to procurements of supplies produced in the country of the other government,” and “accord industries of the other government treatment no less favorable in relation to procurement than that accorded to industries of its own country.”24

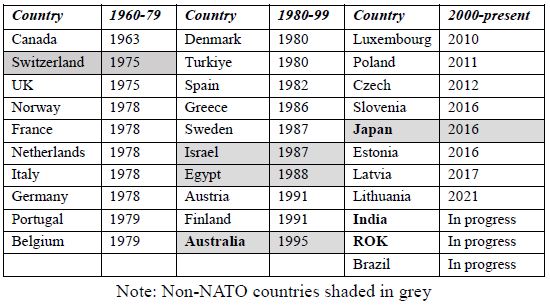

The United States first started signing RDPs during the Cold War to address European allies’ dissatisfaction over the imbalance in defense industrial trade with the United States, eventually signing 16 agreements during the 1970s and 1980s. Today, the United States has RDPs with 28 countries. Among the world’s top 10 largest defense exporters who are U.S. allies and partners, the ROK is the only country that has not yet signed an RDP. In this regard, the ROK has made efforts to sign an RDP to help ease trade barriers for bilateral arms exports. As President Yoon promised to make the ROK the world’s fourth-largest defense exporter by 2027, an RDP is considered a necessary precursor.

Table 1. U.S. RDPs with Partners

The successful negotiation of DIB cooperation agreements will involve more than just the executive branch of government, however. In this regard, ensuring trust and cooperation with the U.S. Congress will be key to unlock more advanced levels of defense industry cooperation and access to U.S. technologies. The U.S. Congress has played an important role in pushing for closer DIB cooperation with the ROK while also taking actions to prevent perceived breaches of trust. For example, the U.S. Congress recognizes the ROK as a higher tier arms purchaser as part of the “NATO Plus Five” list alongside Australia, Israel, Japan, and New Zealand for a higher threshold for non-reporting of FMS sales.25 An RDP is one further way to demonstrate the ROK’s credibility as a trusted industrial partner of the United States.

3. Reconciling ROK-U.S. Defense Industrial Ambitions

Closer ROK-U.S. defense industrial cooperation has significant potential. But it will need to reconcile distinct ambitions between the Yoon and Biden administrations. For the Biden administration, defense industrial cooperation with the ROK is part of a larger strategy of “integrated deterrence” and alliance integration.26 The 2023 U.S. National Defense Industrial Strategy lists key factors in considering the value of an ally for defense industrial cooperation, including “history, shared values, public and political support, as well as security assurance, supply chain resilience, risk diversification, industrial capabilities, technological capabilities, and – not least – strategic goals, economic impact, and cost consideration (italics added).27 As such, a key consideration in cooperating with the ROK depends on aligning global strategic interests with domestic economic interests.

This has been reflected in mixed U.S. success at encouraging the ROK defense industrial base to support missions and efforts beyond the Korean Peninsula. For example, the value of ROK defense industrial capabilities was demonstrated during the Ukraine war when the Yoon administration authorized the transfer of 500,000 ROK stocks of 155mm artillery shells to the United States in 2023 to backfill its own stockpiles, “making South Korea a larger supplier of artillery ammunition for Ukraine than all European nations combined.”28 Similarly, the U.S. Department of Defense is interested in encouraging South Korean naval shipbuilders to invest in U.S. domestic shipyards and potentially play a co-sustainment role, thereby freeing up the U.S. shipbuilding base to meet production targets.29 The United States has already started discussing Maintenance, Repair, and Overhaul (MRO) of its vessels with Japan.

Second, the Biden administration sees benefits in linking South Korean defense firms into closer partnerships with the United States from a bilateral trade perspective. From 2008 to 2016, “approximately 75% of South Korea’s total foreign defense purchases were FMS and commercial sales from U.S. companies.”30 For all of the success of the K-defense export agenda, the ROK continues to be among the top purchasers of U.S. defense articles. For example, Japan, Australia, and the ROK account for 21.9% of all U.S. arms exports, purchasing 9.5%, 7.1%, and 5.3%, respectively between 2019-2023.31 The Biden administration and U.S. defense firms are keen to encourage ROK firms to become partners, invest in the U.S. industrial base and support American manufacturing, and to share technology and advanced research that the United States lacks.32

For its part, the Yoon administration is seeking to achieve two objectives. First, it hopes that closer defense industrial integration in the model of Australia and Japan will lead to similar alliance status and influence. This is evident in recent interest by senior ROK officials in joining the AUKUS Pillar Two partnership for advanced defense technologies, closely following recent announcements that Japan would be invited to cooperate with the AUKUS countries. While higher levels of integration such as ROK membership of the National Technology Industrial Base (NTIB) remain unlikely at the moment, an RDP is seen as one further step in the right direction.33

Second, the Yoon administration believes that cooperation will help unlock or at least moderate the growing protectionist mood in the United States.34 ROK firms have long been eager to tap into the U.S. domestic market, which is the world’s largest, but been restricted by legislation. For example, the Buy American Act (BAA) was first enacted in 1933 in response to the Great Depression and restricts federal government purchases of foreign-produced products, including defense articles. Such protectionist sentiment is currently rising again in the United States. The U.S. Congress is increasing BAA quotas to contain at least 55% of U.S.-manufactured components and such requirements will increase to 65% in 2024 and 75% in 2029.35 As a result, foreign defense companies face an obstacle to competing with the U.S. domestic materials with such legislation that imposes price preference only for purchases of U.S.-origin. Other U.S. legislation, such as the Jones Act and Byrnes-Tollefson Act, make it difficult for South Korea to export defense articles to the United States or cooperate on the construction or sustainment of U.S. commercial or naval vessels.36 Closer defense industrial cooperation, and securing an RDP, therefore allow the ROK to get within the tent of the U.S. defense industry market by being exempted from certain BAA provisions.

4. Policy Recommendations: Aligning Defense Industrial Strategies

These different ambitions cannot be fully reconciled. But they should nonetheless be managed to prevent misunderstanding or disappointment in what ROK-U.S. defense industry cooperation can ultimately achieve. Three strategies could help bridge these competing interests. First, a clearer division of defense industrial labor could ensure that the two countries’ defense firms can maximize complementary roles and at least minimize becoming competitors.37 A U.S. integrated deterrence strategy should balance ‘integration’ with the legitimate ambitions of its allies such as the ROK to develop the defense industry in line with other export industries. The Biden administration appears responsive to this distinction. For instance, the 2024 U.S. Regional Sustainment Framework, which sets out the U.S. Department of Defense’s Indo-Pacific MRO plans, distinguishes strategic partnerships between ‘deliberate integration’ with allies having shared defense systems and enhancing ‘shared capability’ with allies fielding their own existing capabilities.38 This reflects the different contributions that allies such as Australia and the ROK might respectively make to sustainment efforts. Importantly, such an approach would reject full integration of allies into the U.S. industrial base, instead acknowledging the value of separate but coordinated development and production capacities. A key priority for the ROK-U.S. alliance should be authorizing similar co-sustainment of forward-deployed U.S. Navy ships and U.S. Air Force aircraft as announced in the April 2024 U.S.-Japan Joint Leaders’ Statement.39

Second, the ROK and United States could explore cooperation on a single capability, such as missiles, to become a flagship short-term deliverable. Contrary to the significant interest in ROK participation in AUKUS Pillar Two advanced capabilities which include cyber, quantum, electronic warfare, and others, it might make more sense to explore the co-production of a single line of munitions. Anti-ship missiles and surface-to-air missiles would be promising areas for collaboration that could demonstrate immediate strategic effects. ROK artillery units recently conducted missile and artillery tests alongside Japanese military units while participating in the 2023 Australia-U.S. Talisman Sabre military exercise.40 This also aligns with Australia-U.S. defense industry cooperation under the Guided Weapons and Explosive Ordnance (GWEO) enterprise to upscale munitions production. Moreover, Lockheed Martin, which is one of the two GWEO contractors, has a longstanding cooperation with Korea Aerospace Industries on aircraft production.41

Third, the two countries could undertake joint studies into how other U.S. allies have successfully, and perhaps unsuccessfully, collaborated on defense industry projects. Past examples include the U.S.-Japan FSX fighter jet program of the 1990s which offers lessons for the failure of full indigenization and how to manage alliance pressure.42 The current ROK-Indonesia KFX fighter jet program also raises many similar lessons as the ROK becomes the supplier in new partnerships, and not just the importer.43 Other projects such as the AUKUS partnership for submarines and the Japan-UK-Italy Global Combat Air Programme (GCAP) to build a next generation fighter jet could similarly offer new lessons for ROK-U.S. cooperation.44 The ROK and the United States should focus on how to also leave room for future membership of other partners into bilateral projects.

Conclusion

This Issue Brief has argued that for ROK-U.S. defense industrial cooperation to reach its full potential, the two countries should focus on reciprocating trust and reconciling ambitions. The fact is that the ROK has lagged behind other U.S. allies in the legislative mechanisms for closer defense industrial cooperation, such as SOSA and RDP agreements. This is less a consequence of time or effort than it is of trust and differing ambitions. The United States wants the ROK to contribute its industrial base to global missions beyond the Korean Peninsula and support the U.S. defense industry through procurement and investment. The United States will need to reassure the ROK that it supports the ROK’s legitimate aspirations for defense self-reliance and sovereign defense industrial capabilities. The ROK meanwhile aspires to be treated the same as other U.S. allies on defense industrial cooperation and become a trusted supplier to the U.S. defense industrial base and not just a buyer. The Yoon administration and future ROK governments will need to demonstrate that the ROK is prepared to shoulder its fair share of the collective burden of arming allies and partners around the world rather than just viewing defense industry as an extension of export-led growth.

The views expressed herein do not necessarily reflect the views of the Asan Institute for Policy Studies.

- 1. Office of National Security, “The Yoon Suk Yeol Administration’s National Security Strategy: Global Pivotal State for Freedom, Peace, and Prosperity,” Office of the President of the Republic of Korea (June 2023), p. 84.

- 2. Michael J. Green, Zack Cooper, and Kathleen H. Hicks, “Federated Defense in Asia,” The Center for Strategic and International Studies (December 11, 2014), https://www.csis.org/analysis/federated-defense-asia.

- 3. U.S. Department of Defense, “Defense Vision of the U.S.-ROK Alliance” (November 13, 2023), https://www.defense.gov/News/Releases/Release/Article/3586528/defense-vision-of-the-us-rok-alliance/.

- 4. Song Sang-ho, “U.S. Takes Step Toward Signing Defense Procurement Pact with South Korea,” Yonhap News (February 28, 2024), https://en.yna.co.kr/view/AEN20240228000800315.

- 5. Kim Seung-yeon, “S. Korea discussed possible participation in AUKUS Pillar 2 with Australia’s defense minister,” Yonhap News (May 1, 2024), https://en.yna.co.kr/view/AEN20240430010351315.

- 6. Luke A. Nicastro, “The U.S. Defense Industrial Base,” Congressional Research Service (October 12, 2023), https://crsreports.congress.gov/product/pdf/R/R47751, pp. 2-7.

- 7. U.S. Department of Defense, “DOD Report Details Chinese Efforts to Build Military Power” (October 19, 2023), https://www.defense.gov/News/News-Stories/Article/Article/3562442/dod-report-details-chinese-efforts-to-build-military-power/.

- 8. U.S. Department of Defense, “Military and Security Developments Involving the People’s Republic of China, 2023,” https://media.defense.gov/2023/Oct/19/2003323409/-1/-1/1/2023-MILITARY-AND-SECURITY-DEVELOPMENTS-INVOLVING-THE-PEOPLES-REPUBLIC-OF-CHINA.PDF.

- 9. Katie Bo Lillis, Natasha Bertrand, Oren Liebermann, Haley Britzky, “Russia producing three times more artillery shells than US and Europe for Ukraine,” CNN (March 11, 2024), https://edition.cnn.com/2024/03/10/politics/russia-artillery-shell-production-us-europe-ukraine/index.html; Noah Robertson, “Russian military ‘almost completely reconstituted,’ US official says,” Defense News (April 4, 2024), https://www.defensenews.com/pentagon/2024/04/03/russian-military-almost-completely-reconstituted-us-official-says/.

- 10. Andrea Kendall-Taylor and Richard Fontaine, “The Axis of Upheaval,” Foreign Affairs (May/June 2024), https://www.foreignaffairs.com/china/axis-upheaval-russia-iran-north-korea-taylor-fontaine; Kim Eun-jung, “Defense chief says N.K. munitions factories operating at full capacity to supply Russia,” Yonhap News (February 27, 2024), https://en.yna.co.kr/view/AEN20240227002800315.

- 11. Hal Brands, “The Overstretched Superpower,” Foreign Affairs (January 18, 2022), https://www.foreignaffairs.com/articles/china/2022-01-18/overstretched-superpower; Robert M. Gates, “The Dysfunctional Superpower,” Foreign Affairs (September 29, 2023), https://www.foreignaffairs.com/united-states/robert-gates-america-china-russia-dysfunctional-superpower.

- 12. Seth G. Jones, “Empty Bins in a Wartime Environment: The Challenge to the U.S. Defense Industrial Base,” The Center for Strategic and International Studies (January 23, 2023), https://www.csis.org/analysis/empty-bins-wartime-environment-challenge-us-defense-industrial-base.

- 13. The White House, “National Security Strategy” (October 2022), https://www.whitehouse.gov/wp-content/uploads/2022/10/Biden-Harris-Administrations-National-Security-Strategy-10.2022.pdf; Tom Corben and Peter K. Lee, “Fancy Footwork: Biden’s Two-Step Approach to Indo-Pacific Allies,” The Diplomat (March 16, 2022),

https://thediplomat.com/2022/03/fancy-footwork-bidens-two-step-approach-to-indo-pacific-allies/. - 14. Peter K. Lee, Alice Nason, and Sophie Mayo, “Eight expectations for the AUKUS announcement,” United States Studies Centre (February 27, 2023), https://www.ussc.edu.au/eight-expectations-for-the-aukus-announcement.

- 15. For more, see Robert O’Rourke, “Navy Virginia-Class Submarine Program and AUKUS Submarine Proposal,” Congressional Research Service (October 23, 2023) https://news.usni.org/2023/12/27/report-on-virginia-class-attack-submarine-program-aukus-proposal-2.

- 16. The White House, “United States-Japan Joint Leaders’ Statement” (April 10, 2024), https://www.whitehouse.gov/briefing-room/statements-releases/2024/04/10/united-states-japan-joint-leaders-statement/.

- 17. Ken Moriyasu, “U.S. Turns to Private Japan Shipyards for Faster Warship Repairs,” Nikkei Asia (May 24, 2023), https://asia.nikkei.com/Politics/International-relations/Indo-Pacific/U.S.-turns-to-private-Japan-shipyards-for-faster-warship-repairs.

- 18. Ministry of Foreign Affairs of Japan, “Japan’s Policies on the Control of Arms Exports,” https://www.mofa.go.jp/policy/un/disarmament/policy/index.html.

- 19. U.S. Department of Defense, “Joint Press Statement for the 24th Korea-U.S. Integrated Defense Dialogue” (April 11, 2024), https://www.defense.gov/News/Releases/Release/Article/3739122/joint-press-statement-for-the-24th-korea-us-integrated-defense-dialogue/.

- 20. “Lockheed Martin Announces MoU With Kencoa Aerospace Corporation To Support The C-130J Super Hercules Global Supply Chain,” Lockheed Martin (October 19, 2023), https://news.lockheedmartin.com/2023-10-19-Lockheed-Martin-Announces-MoU-with-Kencoa-Aerospace-Corporation-to-Support-the-C-130J-Super-Hercules-Global-Supply-Chain; “South Korea and Boeing to jointly research long-endurance aerial UAVs,” Shepard Media (November 24, 2023), https://www.shephardmedia.com/news/air-warfare/south-korea-and-boeing-to-jointly-research-long-endurance-aerial-uavs/.

- 21. “Security of Supply Arrangement Between the Ministry of National Defense of the Republic of Korea and the Department of Defense of the United States of America” (October 30, 2023), https://www.businessdefense.gov/docs/sofs/US-ROK-SOSA-15Nov2023.pdf ; Industrial Base Policy, “Security of Supply,” https://www.businessdefense.gov/security-of-supply.html.

- 22. Chae Yun-hwan, “S. Korea, U.S. Agree to Sign Arrangement on Bolstering Defense Supply Chains,” Yonhap News (July 31, 2023) https://en.yna.co.kr/view/AEN20230731002300325.

- 23. The White House, “Leaders’ Joint Statement in Commemoration of the 70th Anniversary of the Alliance Between the United States of America and the Republic of Korea” (April 26, 2023), https://www.whitehouse.gov/briefing-room/statements-releases/2023/04/26/leaders-joint-statement-in-commemoration-of-the-70th-anniversary-of-the-alliance-between-the-united-states-of-america-and-the-republic-of-korea/.

- 24. Office of the Assistant Secretary of Defense (Acquisition), “International Contracting – Reciprocal Defense Procurement and Acquisition Policy Memoranda of Understanding,” https://www.acq.osd.mil/asda/dpc/cp/ic/reciprocal-procurement-mou.html.

- 25. Mark E. Manyin, Mary Beth D. Nikitin, Caitlin Campbell, Brock R. Williams, and Emma Chanlett-Avery, “U.S.-South Korea Relations,” Congressional Research Service (October 8, 2015), https://crsreports.congress.gov/product/pdf/R/R41481, p. 28.

- 26. Department of Defense, “U.S. National Defense Industrial Strategy” (November 16, 2023), https://www.businessdefense.gov/docs/ndis/2023-NDIS.pdf.

- 27. Ibid, p. 46.

- 28. Washington Post Staff, “Miscalculations, Divisions Marked Offensive Planning by U.S., Ukraine,” The Washington Post (December 4, 2023), https://www.washingtonpost.com/world/2023/12/04/ukraine-counteroffensive-us-planning-russia-war/; Missy Ryan, Emily Rauhala, “With U.S. Aid in Doubt, Europe Struggles to Rearm Ukraine,” The Washington Post (February 24, 2024), https://www.washingtonpost.com/national-security/2024/02/24/europe-ukraine-ammunition-shells/.

- 29. U.S. Mission Korea, “The U.S.-ROK Relationship: An Alliance for the Greater Good,” U.S. Embassy & Consulate in the Republic of Korea (December 1, 2022), https://kr.usembassy.gov/120122-the-u-s-rok-relationship-an-alliance-for-the-greater-good/; Ron O’Rourke, “Competition at Sea: Building Resilience in a Maritime Enterprise in Crisis,” Wilson Center (March 28, 2024), https://www.wilsoncenter.org/event/competition-sea-building-resilience-maritime-enterprise-crisis.

- 30. Cha Eunhyuk, “South Korea Approves Procurement of SM-3 For Ballistic Missile Defense,” Naval News (April 26, 2024), https://www.navalnews.com/naval-news/2024/04/south-korea-approves-procurement-of-sm-3-for-ballistic-missile-defense/.

- 31. Pieter D. Wezeman, Katarina Djokic, Mathew George, Zain Hussain, and Siemon T. Wezeman, “Trends in International Arms Transfers, 2023,” Stockholm International Peace Research Institute Fact Sheet (March 2024), https://www.sipri.org/sites/default/files/2024-03/fs_2403_at_2023.pdf, p. 6.

- 32. Seunghwan Kim, “South Korea’s Defense Boost Benefits Texas and Virginia,” Asia Matters for America (November 1, 2023), https://asiamattersforamerica.org/articles/south-koreas-defense-boost-benefits-texas-and-virginia.

- 33. William Greenwalt, “Leveraging the National Technology Industrial Base to Address Great-Power Competition: The Imperative to Integrate Industrial Capabilities of Close Allies,” Atlantic Council (April 2019), https://www.aei.org/research-products/report/leveraging-the-national-technology-industrial-base-to-address-great-power-competition/, p.3.

- 34. Yoo Yongwon, “Yoon Administration Seeks to Sign an RDP to Enter into the U.S. Defense Industry Market [in Korean]” (December 28, 2023), https://www.chosun.com/politics/politics_general/2022/05/02/ZGYQQN7ZTFAEPLIXLLN6BOL5AI/.

- 35. The White House, “Executive Order on Ensuring the Future Is Made in All of America by All of America’s Workers” (January 25, 2021), https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/25/executive-order-on-ensuring-the-future-is-made-in-all-of-america-by-all-of-americas-workers/.

- 36. Colin Grabow, “The Self-Imposed Blockade,” CATO Institute (August 16, 2022) https://www.cato.org/policy-analysis/self-imposed-blockade.

- 37. Jonathan Caverley, Ethan Kapstein, Jennifer Kavanagh, “One Size Fits None: The United States Needs a Grand Defense Industrial Strategy,” War on the Rocks (November 16, 2023), https://warontherocks.com/2023/11/one-size-fits-none-the-united-states-needs-a-grand-defense-industrial-strategy/.

- 38. U.S. Department of Defense, “2024 Regional Sustainment Framework,” https://www.acq.osd.mil/asds/docs/RSF-9MAY24.pdf.

- 39. The White House, “United States-Japan Joint Leaders’ Statement” (April 10, 2024), https://www.whitehouse.gov/briefing-room/statements-releases/2024/04/10/united-states-japan-joint-leaders-statement/.

- 40. Mike Yeo, “Japan, South Korea Fire Missiles in Australia for First Time,” Defense News (July 25, 2023), https://www.defensenews.com/training-sim/2023/07/24/japan-south-korea-fire-missiles-in-australia-for-first-time/.

- 41. Australian Government, “Guided Weapons and Explosive Ordnance Enterprise,” https://www.defence.gov.au/business-industry/industry-capability-programs/guided-weapons-explosive-ordnance-enterprise

- 42. Michael J. Green, Arming Japan: Defense Production, Alliance Politics, and the Postwar Search for Autonomy (Columbia University Press, 1995).

- 43. Lee Hyo-jin, “What’s next for KF-21 project after Indonesia’s funding slash?” The Korea Times (May 21, 2024), https://www.koreatimes.co.kr/www/nation/2024/05/113_375050.html.

- 44. Gabriel Dominguez, “Japan’s Next-Gen Fighter Project with U.S. and Italy Hits Milestone,” The Japan Times (December 14, 2023), https://www.japantimes.co.jp/news/2023/12/14/japan/politics/japan-uk-italy-joint-fighter-jet-development/.

Facebook

Facebook Twitter

Twitter