THE ASAN PUBLIC OPINION BRIEF

Tax Reform

SUPPORT FOR THE TAX REFORM BILL (1/2)

August 3-5

Do you support or oppose the current tax reform bill?

(%)

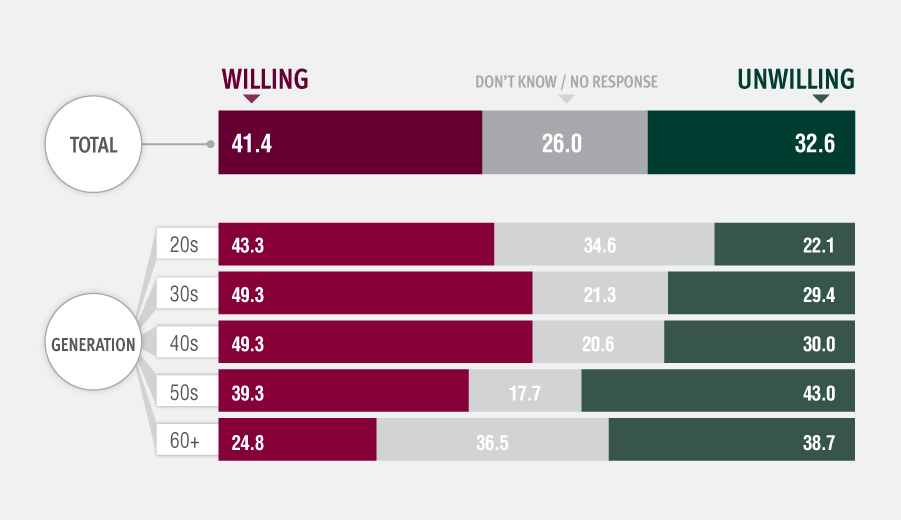

A plurality (41.4%) opposed the bill with 32.6% in favor. Opposition was stronger among those in their twenties, thirties, and forties, while a plurality of those in their fifties and sixties or older approved. Nearly one-third of those in their twenties and sixties or older responded as “Don’t Know”, showing an overall lack of interest in the subject.

Notably, even among the taxpaying age groups, there is a significant divide between those in their thirties and forties and those in their fifties. Those in their thirties and forties, who tend to be economically less secure, were more likely to oppose the tax reform than those in their fifties (Opposition to tax reform bill: Thirties, 49.3%; Forties, 49.3%; Fifties, 39.3%).

In terms of occupation, more white-collar workers (56.3%) and blue-collar workers (47.2%) opposed the bill than people in other occupations.

While media outlets predicted a public uproar against the bill, in reality it was not a significant majority that opposed the bill.

METHODOLOGY

- The sample size of each survey was 1,000 respondents over the age of 19.

- The surveys were conducted by Research & Research, and the margin of error is ±3.1% at the 95% confidence level.

- All surveys employed the Random Digit Dialing method for mobile and landline telephones.

3-day rolling average?

The sample size of each survey was 1,000 respondents over the age of 19. The surveys were conducted by Research & Research, and the margin of error is ±3.1% at the 95% confidence level. All surveys employed the Random Digit Dialing method for mobile and landline telephones.

This brief is a product of the Public Opinion Studies Center at the Asan Institute for Policy Studies.

Contact Karl Friedhoff at klf@asaninst.org.

Facebook

Facebook Twitter

Twitter